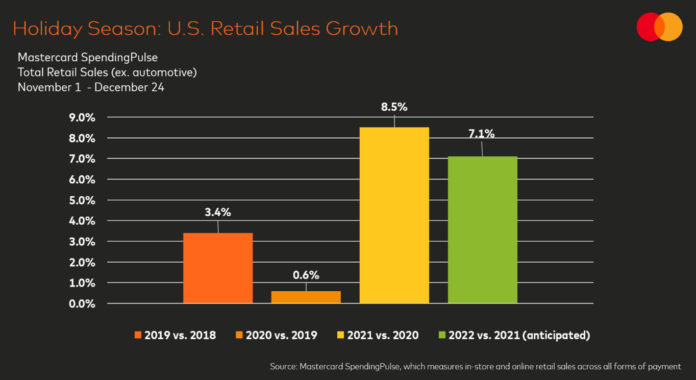

This holiday season, U.S. retail sales (excluding automotive) are expected to increase 7.1 percent year over year, according to the Mastercard SpendingPulse annual holiday forecast. Measuring in-store as well as online retail stores across all forms of payment, Mastercard SpendingPulse bases its findings on aggregate sales activity in the Mastercard payments network, coupled with survey-based estimates for other payment forms, such as cash and check.

“This holiday season, consumers may find themselves looking for ways to navigate the inflationary environment – from searching for deals to making trade-offs that allow for extra room in their gift-giving budgets,” says Michelle Meyer, U.S. chief economist, Mastercard Economics Institute. “New job creation, rising wages and lingering savings should have many consumers ready and able to spend.”

Key trends to watch this holiday season (November 1 – December 24), notes Mastercard SpendingPulse, include:

- Extended holiday shopping: With holiday shopping slated to begin early again this year, some of the season’s retail growth is expected to be pulled forward in October as consumers hunt for early deals. Key promotional days like Black Friday weekend are also expected to make a strong return along with Christmas Eve, which falls on a Saturday, slated to be among the biggest days for retailers and last-minute shoppers. To understand how holiday shopping is shifting, check out the extended 75-day holiday forecast here.

- ‘Tis the season of savings: As inflation impacts consumer wallets, bargain hunting is expected to be in full force this holiday season. From deals and discounts to price monitoring and price matching, consumers are looking to stretch their dollars and get the most bang for their buck. E-commerce is anticipated to increase despite significant growth last year, up +4.2 percent YOY/ +69.2 percent YO3Y, as the channel remains a convenient way for consumers to check prices in real time.

- In-store experiences draw shoppers to stores: From the return of holiday doorbusters to new brick-and-mortar collaborations, retailers are aiming to boost holiday spirits by driving consumers into stores. In-store retail sales are expected to be up +7.9 percent YOY/ +10.4 percent YO3Y. While e-commerce has seen marked growth in recent years, in-store spending made up more than 4/5 of retail sales from January through August 2022.

- Fashion-forward gifting: Following nearly two years of loungewear and athleisure, consumers may be adding revamped wardrobes to their wish lists as social events and platforms have many dressing to impress. Apparel (+4.6 percent YOY/ +25.3 percent YO3Y) and Luxury (+4.4 percent YOY/ +29.6 percent YO3Y) are expected to be hot holiday gift sectors, sending consumers into the new year in style.

“This holiday retail season is bound to be far more promotional than the last,” says Steve Sadove, senior advisor for Mastercard and former CEO and chairman of Saks Incorporated. “Easing supply chain issues coupled with the rapid shift in consumer spending trends and over-ordering inventory have left retailers in an interesting position ahead of the holidays. Retailers that were able to clear past merchandise and accurately forecast inventory needs will be the best positioned for growth.”

The holiday forecast, along with a look at key economic trends shaping the season, can be downloaded from the Mastercard Economics Institute here.