The continued impact of inflation as well as a shift in consumer priorities will define the 2022 holiday season, forecasts Deloitte in its 2022 Deloitte Holiday Retail Survey report. The report examines what retailers can likely expect from consumers shopping for the holidays. Deloitte also explores holiday travel intent to help provide a complete spending picture this holiday season in its complementary report, 2022 Deloitte Holiday Travel Survey.

For both studies, Deloitte surveyed 4,986 consumers online in September 2022. From that group, 1,540 respondents who noted they would take a leisure trip this season and stay at paid lodging or with family or friends qualified as holiday travelers. For the holiday retail survey, Deloitte also polled 40 retail executives across categories, of which 93% were from retailers with annual revenues of $1 billion or more, also conducted in September.

Consumers remain festive – despite a ‘bah-humbug’ environment

Inflation is taking its toll for the second consecutive holiday season in a row, the survey found. More than one-third of American households (37%) say their financial situation is worse than last year, and 41% expect the economy to weaken next year, compared with 33% in 2021.

Nonetheless, lower-income groups (those making less than $50,000 per year) indicated they plan to spend an average of $671 this holiday season, an increase of 25% year-over-year vs. 2021 and similar to 2019 levels. Conversely, spending by higher-income earners (those making $100,000 or more per year) is expected to decline 7% year-over-year to an average of $2,438, as they pull back on categories like electronics. Overall, consumers plan to maintain spending levels year-over-year by prioritizing shared experiences and cutting back on the number of gifts purchased.

- Inflation will likely impact consumers’ spending this holiday season, for both those planning to spend more and those planning to spend less. When asked about the reasons for the change in year-over-year spending plans, 51% of those spending more attributed it to higher costs (versus in 2021) as did 66% of those spending less, similar to 2021 (67%).

- Spending on experiences, which includes entertaining at home and socializing away from home, is expected to increase 7% year-over-year, to $575 per household. Spending on gifts is nearly the same year-over-year at $507 per household, though consumers plan to purchase fewer gifts.

- Retail executives, however, are more optimistic: 77% expect holiday sales to increase year-over-year.

- With consumers planning to wrap fewer gifts, they will spend less time shopping (5.8 weeks versus 6.4 weeks last year), visit fewer websites and apps (9.1, compared to 11.1 in 2021), and visit fewer stores (5.9, down from 6.6 in 2021).

- Prompting shoppers to get a head-start on holiday deals, 60% of retailers surveyed say their companies will start holiday promotions at least one to two weeks earlier than last year.

- Amid higher prices and supply-chain concerns, gift cards are becoming the go-to gift, prompting an average spend of $252 this year, up 7% from 2021.

- Gifting resale items continues to be a key cost-saving strategy as consumers look for ways to maximize spending: 32% of shoppers plan to buy resale items, and nearly half of surveyed retail executives (48%) will sell refurbished or used products this season.

Consumers return to stores, but digital behaviors still prevail

With pandemic anxieties waning, consumers continue to warm up to in-store shopping – but are not ready to give up the convenience of shopping online. This preference for digital is also driving increased interest in social media and advanced technologies for holiday purchases.

- The share of in-store spending is expected to rise to 35% in 2022 (up from 33% in 2021), which is nearly on par with the 36% seen in 2019.

- Online continues to be a holiday shopping mainstay, holding steady with a 63% share. Further, the use of smartphones for online holiday shopping is steadily rising, from 52% in 2019 to 56% in 2022.

- Consumers continue to value convenience for their holiday shopping, citing online (56%) and mass merchants (49%) as the most preferred retail formats. This year, grocery stores will likely see a boost in traffic (24% in 2022, compared to 19% in 2021).

- As digital-native generations gain purchasing power, social media continues to grow as a resource for shoppers. More than one-third (34%) plan to use social media for holiday shopping, and this is even higher for GenZ (60%) and millennials (56%). Further, 30% of holiday shoppers follow influencers for product recommendations, up from 24% in 2021.

- Future-minded consumers are exploring non-traditional platforms, with more shoppers (35% versus 25% in 2021) planning to use technologies like cashier-less stores, live/interactive video streaming, shoppable content and “buy now” buttons on social media.

Past supply-chain issues push shoppers to start early

While empty shelves and shipping delays were frequent last holiday season, retailers are more confident about inventory levels. However, amid inflation, brand loyalty may be harder to capture as lower prices and better availability will likely lure shoppers away from their standby brands and retailers.

- More than three-quarters of shoppers (77%) expect stockouts this season. However, retail executives are more optimistic: More than half (60%) are comfortable with the volume of holiday merchandise ordered, and all surveyed (100%) anticipate receiving their holiday inventory on time — versus 57% reporting the same in 2021.

- The holiday shopping season continues to pull forward, with 23% of holiday budgets spent by the end of October, compared to 18% in 2021. Early shoppers are doing so to help ensure timely delivery (42%) and avoid stockouts (41%).

- Though the season is moving up, nearly half (49%) of holiday shoppers plan to participate in Thanksgiving week events, up from 47% in 2021. Three in 10 holiday shoppers plan to spend on Black Friday (29% versus 25% in 2021), and Cyber Monday (30% versus 27% in 2021).

- More than half of consumers (60%) will trade brands if their preferred brand is not in stock, and they will check stock availability before making a shopping trip. Nearly two-thirds (65%) will trade brands if prices are too high.

“High prices have holiday shoppers prioritizing their purchases, but there are bright lights throughout the season,” says Nick Handrinos, vice chair, Deloitte LLP, and U.S. retail, wholesale and distribution and consumer products leader. “Lower-income families feel more confident heading into the holidays, younger generations are embracing new retail formats, and retailers do not anticipate the issues with stockouts we saw last year. As consumers aim to be strategic about their purchases to outsmart inflation, retailers who can be flexible to meet consumers where they are will be more likely to build loyalty and profit from the holiday season and beyond.”

Holiday travel slows, laptop luggers take off

As Americans reevaluate their spending for this holiday season, Deloitte reports, more are planning to stay home, with both financial concerns and travel issues, including flight delays and cancellations, weighing on their decisions. Less than one-third (31%) plan to travel between Thanksgiving and mid-January, down from 42% a year ago. For those who will travel, reuniting and spending time with loved ones is the biggest motivation to travel in 2022.

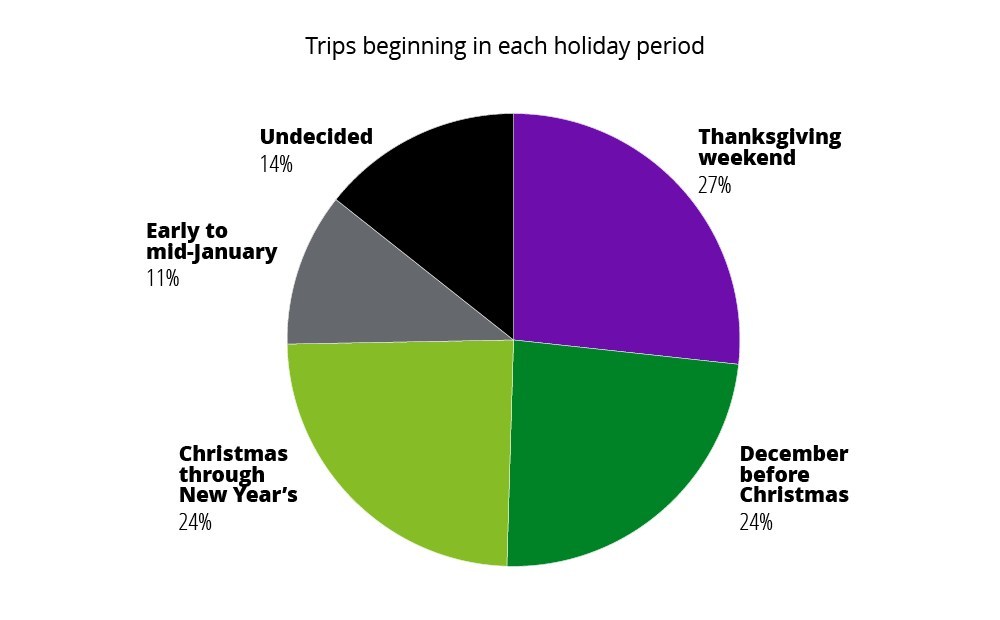

- This season will see 15% of Americans planning to travel on Thanksgiving weekend; 14% plan to travel between Christmas and New Year’s.

- Financial considerations (selected by 37% of non-travelers as a reason not to travel) are this season’s most significant drag on travel demand, and one in five Americans staying home cite worries about travel disruption.

- Of those planning to travel, three out of four plan to spend the same or less than they spent in 2021. This year’s average holiday travel budget (including transportation and lodging costs) will reach $1,287.

- Thanksgiving will be the busiest time for travel, but the trips are short: 8 out of 10 trips during Thanksgiving will be one week or shorter. While only 10% of holiday trips are planned for early January, nearly half of those will be longer than a week.

- Nearly half of holiday travelers (46%) plan to take a flight, up from 37% last year. Given the drop in overall travel demand, the share of total Americans taking a flight (14%) will be similar to 2021 (15%). More than a quarter (29%) plan to fly domestically, and international travel is up seven percentage points from last year.

- Among travel product categories, lodging demand will see the biggest dip, with 59% of holiday travelers planning to stay with friends or family. More than one-third (35%) will stay at a hotel (down from 37% in 2021), and 15% will book a private rental (down from 17%).

- Older Americans, who were more enthusiastic for travel after the pandemic conditions improved, are once again staying home. Only 22% of Americans 55 and older plan to travel, down from 36% in 2021. Older Americans are more affected by concerns about delays and cancellations than younger Americans.

- Laptop luggers’ zest for travel continues as more than a quarter of travelers (26%) intend to work on their longest trip of the holiday season. Those planning to do some work during their vacations take more trips (2.4 versus 1.6 for disconnectors).

- Younger age groups, including 18-34-year olds (37%) and 35-54-year olds (27%), are more likely to work on their trips. However, laptop lugger behavior is more similar across income groups: 30% for middle-income travelers, 27% for lower-income travelers, and 23% among higher-income travelers.